- June 11, 2021

- Posted by: admin

- Category: BitCoin, Blockchain, Cryptocurrency, Investments

Why bitcoin is not only the best investment of our time, and the only good “crypto,” but the only moral, economic and philosophically sound place to store your wealth.

Hint: Beyond Bitcoin, it’s ALL shitcoin.

I often get asked about “which crypto” is a good one to invest in. Of course, my answer is always bitcoin. Period.

In this article I’d like to lay out the rationale from three angles:

- Economic

- Philosophic

- Moralistic

They all weave into and build on top of each other. If you’re a Bitcoiner, I hope this reminds you of why we’re here. If you’re a no- or multi-coiner, I hope this helps you along the path and also to realize why Bitcoiners are so adamant about it.

It’s not close-mindedness, but an arrival to a point of truth. We have one chance to take down the Goliath. Wasting time on distractions doesn’t help you, me or anybody else for that matter.

Let’s begin.

The Economic Rationale

On a long enough time frame, every single government issued money, cryptocurrency, stock, bond, property or asset of any kind will trend toward zero when priced in the hardest, most liquid, sound money that’s ever emerged.

And it won’t happen by the fiat decree of some organization or institution. It will happen by pure economic natural selection, or what I like to call “Economic Darwinism.”

Money is the cornerstone of all civilization.

It’s how we store and exchange the product of our labor, and subjectively measure our individual inputs into society. It’s the fabric that binds us. It enables us to cooperate across time and space, both at scale and in greater degrees of complexity. Money has and always will exist. The only thing that changes and evolved over time is what we use as money.

We’ve now arrived at a point where money can be represented perfectly.

Money is the biggest market.

There is no larger segment of the global market. Not energy, not food, not transport, not government, entertainment, healthcare or anything else.

Money is larger than all of them, because it represents all of them, combined.

Today, because we have broken money, many of us hold different assets with different attributes in order to store value and protect our wealth. But, with the emergence of a perfect money, that is immune to confiscation, inflation and corruption, that can be taken anywhere, anytime and sent or received by anyone for any reason, without requiring permission, we will see the monetary premium being stored in these other goods or assets diminish.

As Bitcoin transforms into a unit of account, through which all other goods, services and anything of value is measured, the purchasing power of a full bitcoin will trend toward heights that few could today fathom.

My friend Knut Svanholm dubbed it most accurately:

Everything there is, divided by 21 million.

Economic Necessity

As more people realize that the product of their labor (i.e., their wealth, their savings and their money) is constantly being eroded, they are going to seek to store it in something that cannot be diluted. Bitcoin is the best possible option. It is accessible all around the world, and can be stored as pure, unadulterated, unconfiscatable information.

Whether you’re rich or poor, left or right, employer or employee, storing your wealth somewhere safe is only getting more important.

In the same way you would not work all week only to accept salt from your employer as payment, as more time passes, less and less people are going to accept inferior government issued, or random-developer issued fiat money as payment for any of their goods and services.

In fact, future generations will look back on us today and wonder how, in the name of all that is sane, did we believe that measuring our wealth in a currency or money issued by some overlord, that devalued over time, ever made sense. It’s antithetical to the notion of progress and freedom.

Bitcoin is perfect money.

Bitcoin is superior to all other forms of money because it perfectly embodies every attribute of the meta-idea that is money. It’s open source; always on; not just fixed, but known in supply; verifiable by anyone; voluntary; permissionless; digital and directly rooted in the second law of thermodynamics. As a result, it performs the functions of money flawlessly.

- It’s the perfect store of value:

I know exactly how much I have in relationship to the whole, and I know that it cannot be diluted, altered or co opted. - It’s the perfect medium of exchange:

I can send what I want, to whom I want, whenever I want and there is no power in the universe that can stop me from doing so. - It’s the perfect unit of account:

I can measure all other goods and services in sats and as the purchasing power grows, it’s pure digital nature means we can continue to sub-divide the units to measure smaller and more fractional goods and services, forever.

The best money always wins.

There is no outcome where Bitcoin loses, because the best money always wins by the sheer force of natural selection and survival.

Gold and silver emerged victorious over millennia of monetary war. Gold-backed promissory notes then crushed silver. Gold was then defeated by its leviathan: nation-state fiat.

Now, bitcoin emerges, as the alpha-omega of money, and it will strip all assets of their monetary premium.

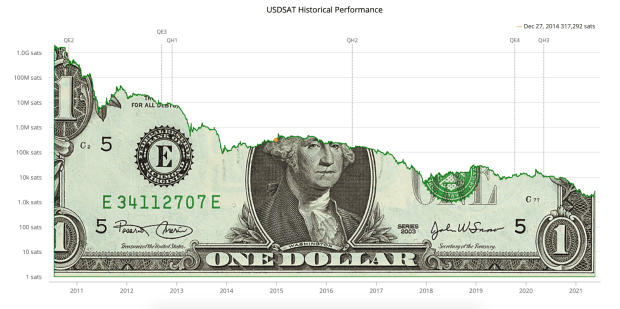

It’s been happening for 12 years straight already. Go ahead and measure any asset in the world against bitcoin, and you’ll find that it’s down anywhere between 90% to 99% since its inception, when priced in bitcoin.

And this is only the beginning. Bitcoin hasn’t started sucking the air out of the larger asset classes yet.

Source:

The longer the chart, the worse it looks for the USD.

This is a log chart, so the fall doesn’t look as drastic, but you can see USD has devalued many order of magnitude against bitcoin

See the full chart and data here:

2,879 sats (this website is a live view of the price of the USD in satoshis).

Convergent Network Effects

Money, like language, has a convergent network effect, meaning that it’s most useful when on a common standard.

In fact, transport, transmission and communication media all converge around particular standards in order to optimize for efficiency.

You see it everywhere:

- The protocol stack that represents the internet, ie; TCP/IP, HTTP

- The gauge on train tracks (which was the same gauge on Roman chariots)

- Shipping container sizes

- Vowels and consonants in any particular language

Money is the grandest, oldest language and energy transmission medium of all. It’s how we measure, store and transact human action and it has been with us since the beginning of time.

As a result, money is a winner-take-all game.

Because it’s the most important language of all, and because each individual wants to naturally select that which performs each function of money best, the hardest, soundest, most powerful money comes out on top.

Today, the USD reigns supreme not through merit, but because it is enforced by a kabal. Bitcoin will be the global standard, not because of some fiat decree or the force of the nation state, but through natural, market selection.

That’s what makes it so powerful.

The Philosophical Rationale

The economic case for bitcoin stems from the philosophy of Bitcoin and the principles it embodies.Bitcoin is about a move away from “rulers” and toward “rules.”

It does this because of a series of market-selected attributes it has, and because it has emerged organically in a path-dependent order. The three core innovations of Bitcoin are:

- Digital scarcity

- Autonomous consensus

- Digital immutability

These are the result of the zero-to-one moment that occurred on January 3, 2009, with the Bitcoin genesis block.

The immaculate conception has occurred and the path that Bitcoin has followed since can no longer be repeated. It was a once-in-history genesis and series of path-dependent events.

We now have a perfect money and a perfect monetary network that anyone, anywhere can use and/or build on.

This is the future, and what follows are elements of the Bitcoin philosophy which make it unique.

Decentralization

The word “decentralized” gets thrown around a lot, but it doesn’t mean much outside of the context of actual control or cheap verifiability at the level of the individual.

In 2017, we had the block-size wars with a faction of Bitcoiners who believed that transactional throughput on the base layer was more important than ensuring the network was as cheaply verifiable as possible.

Multiple forks of Bitcoin split from the main chain, and there was even an attempt by miners and large-scale exchanges to coerce the network into doubling the block size as part of some “reasonable middle ground.”

It too failed, showing not only the resilience of the network to attack (whether internal or external), but the decentralized nature inherent in Bitcoin. The citizens of the network, the node operators, rejected the corporate and overlord versions of bitcoin, and the HODLers put their money where their mouths were and backed Bitcoin, not some knock-off version.

Today, it is cheaper than ever to run your own node, and as such, Bitcoin’s network topography is ever more decentralized. In fact, it’s the only network on which you can be a first-class citizen that enforces the Bitcoin consensus rules for less than $100!

Ethereum, for example, is so bloated that YOU CANNOT download the blockchain and run a node. In fact, it’s about to get a whole lot worse because once it moves to proof of stake, the 32 ETH required to be a validator will price 99.9% of people out. In other words, Ethereum will be run by those with all of the ETH. Sounds just like modern central banking to me.

The BCashers,BSVers are in the same boat. They chose to scale their base layer linearly, by increasing the block size. Empty blocks aside (i.e., nobody is using these things), this has resulted in a bloated blockchain with a single group of validators (only miners). There are no node operators on these networks and the larger their blockchain grows, and the more junk they throw on it, the more it will require data-center-level operators to not just mine but actually store their blockchains, leading toward complete centralization.

They’re there already. BSV is basically run by one company: CoinGeek. Bcash is run by Roger Ver. So much for decentralization.

The trade-offs made by Bitcoiners and the Bitcoin network have been naturally selected to ensure maximum decentralization and, as such, maximum aversion to change of any kind. Therein lies its strength as a standard.

Nic Carter wrote a brilliant piece on Bitcoin’s trade-offs here: “Bitcoin Bites The Bullet.”

Layers

Nature scales in layers. Engineering scales in layers. All human cooperation scales in layers. Communication networks, energy transmission media and all other networks we’re aware of scale in layers.

The Bitcoin network’s layered approach is in line with what works.

It’s not only impossible to make a single layer do everything, but it’s an absolutely ridiculous pursuit.

Everything you add begins to impact another element. What some people fail to realize (much like central planners and bureaucrats) is that every action has a reaction and every decision has a cost or a consequence.

In the prior example, I noted that by trying to cram more transactions and data onto the base layer, you make it more expensive for people to run a node, thereby impacting the network’s decentralization.

The same goes for attempting to make the base layer private. The cost of doing this is the sacrifice of verifiability and auditability of the base chain. That’s not a price we need to pay, especially when we can abstract privacy to a higher layer.

One of Bitcoin’s greatest strengths is its native scripting language, which enables the codification of simple contracts. This allows the abstraction of things like transaction throughput, multiparty authorization and privacy without having an impact on the security, decentralization and immutability of the base layer.

In fact, it allows Bitcoin to scale across multiple dimensions exponentially. With Lightning, for example, anyone can be a node for transactions, which means throughput can scale geometrically.

This is so incredibly important, but seems to be lost on linear thinkers.

Finally, the layered nature of Bitcoin means that not only do the network effects get stronger and compound on themselves, but the network becomes more and more decentralized. We introduce new layers to the network, each with their own skin in the game, making it ever more difficult for any participant, group or layer to have influence over another.

It’s engineering perfection.

Censorship Resistance

When people talk about decentralization, they fail to realize that this is actually a means to a more important end.

That end is the network’s resistance to change or censorship.

This is categorically the most important attribute for a global digital money. Something whose supply cannot be altered, whose medium of exchange function cannot be censored and whose rules cannot be directed by anyone.

And how does Bitcoin achieve this?

COST.

Bitcoin transforms raw energy, via computational work (something that cannot be forged or faked) into monetary energy, giving us a thermodynamic guarantee of truth. This is further enhanced by the spread of full node operators, Bitcoin HODLers, second layer operators and infrastructure players all around the world.

There is no amount of money available or coordination possible to try and co-opt the network. The cat is out of the bag.

To learn more about immutability and security as functions of COST (i.e., proof of work), not “blockchain,” see the initial chapters of The Bitcoin Times, “Edition One” and “Breaking The Blockchain.”

Verifiability

As mentioned in the decentralization section, one of Bitcoin’s core value propositions is that anybody, anywhere can verify the rules and status of the network, at any point in time.

Furthermore, anybody who does so is actually the one enforcing the rules of the network at the local level.

Cheap, simple, quick, easy verifiability is at the core of what makes Bitcoin not only robust, but extraordinarily decentralized.

This is practical, economic, real decentralization. Not some theoretic bullshit pushed by some academics who built a “model” on their computer and are now claiming some “decentralization coefficient.”

The progression is as follows:

Verifiability → Decentralization → Censorship Resistance

Individuality

Bitcoin is not democratic. It’s purely anarchic.

It is enforced at the level of the individual. When I run my node, I enforce the Bitcoin rules for me. I just happen to be in alignment (or consensus) with millions of others who are running the Bitcoin rules for themselves too.

We’re not forced to agree. We’re not “told” by anyone. We’re not organized by some central authority. We run it locally, and we achieve consensus globally.

This is free market perfection in action. In fact, it’s the agorist, voluntarist, libertarian and anarcho-capitalist’s dream.

It’s a network with rules, which we enforce as individuals and is made up of others who agree and enforce the same rules

Unlike the corrupt collectivist models under which we live, where my opinion has an impact on somebody else’s life, liberty or property and likewise theirs on mine, Bitcoin is pure voluntary individualism.

My decisions have no bearing on you, nor yours on me. In fact, this is a key to Bitcoin’s immutability. Anyone is free to go and make up their own Bitcoin rules or change them should they wish to. It has no impact on me and the rest of the Bitcoiners who’ve adopted and are enforcing the Bitcoin consensus rules for ourselves. They who change the rules will just “fork off” onto their own network, by themselves. The rest of us continue on like nothing ever happened.

Bitcoin’s defense is in its complete openness. There’s nothing anyone can do to change Bitcoin for me. You can only change it for you.

Voluntary

Bitcoin is a force of nature that emerges in a vacuum of force and coercion. Bitcoin doesn’t “make” you do anything. It cares not whether you buy it, hold it, spend it, save it, send it or receive it. Bitcoin just is, and what you do with it is up to you.

Governments and central banks, on the other hand force you, at barrel of a gun and threat of imprisonment, to use their money. If their money was so good, why all the hostility? Why the legal tender laws? What are they afraid of? And what about the double standards?

Why is it perfectly legal for them to print and create it from thin air, but if you do it, you’re either thrown in jail or you’re suffocated by a knee to the throat from some cop?

Anytime you’re forced to use and accept something, know that it’s inferior. Know that you’re the product.

Bitcoin is winning not by coercion, but through sheer natural selection.

Despite the force, despite the threats, despite the so-called “might and promise of the governments of the world,” bitcoin continues to gain market share. It continues to suck the air out of the room for all the fake government toilet paper they try to pass off as money.

Over the past 12 years, Bitcoin started from $0, and since then, every single national currency that is forced down our throats by government bureaucrats is down 99% against it. And this is only the beginning.

See usdsat.com and casebitcoin.com to get a clear, empirical view of Bitcoin’s statistics since the start.

No Head Of The Snake To Cut Off

Something that happened with Bitcoin, that will never be replicated because it was a one-time, path-dependent event, is the disappearance of Satoshi. Let’s recap:

- Bitcoin emerged as a zero-to-one innovation

- At a time when something like this was thought impossible

- It was planted during the 2008 global financial crisis, with a deep, clear message

- It was picked up by the early cypherpunks and libertarians

- It was dismissed, ignored, disparaged and ridiculed by everyone else

- It continued to spread under the radar

- It was used on Silk Road, which proved it could not be stopped

- Its proof of work grew, as did the number of nodes, HODLers, believers and the infrastructure needed to move people out of fiat and into bitcoin

- The creator disappeared and left it to the world, to do with as we wish

There was a time to kill Bitcoin, and that was somewhere in its first few years of its life. But instead, it was laughed at. The cat is now well and truly out of the bag.

Unlike Ethereum or any other shitcoin out there, which if the government wants to co-opt or shutdown, it can just call the head office, Bitcoin is impossible to turn off. There is no kill switch. There is no “off” button. Bitcoin will survive the internet, the electricity grid and it will survive all of us. In the same way you cannot kill an idea, you cannot turn off information. Information lives on in us, through us and around us. This is the gift Satoshi gave us when he disappeared.

For this, he will go down in history as the greatest hero of all time.

The Moral Rationale

The moral case stems from the philosophy of Bitcoin.

Rules, Not Rulers

Bitcoin’s raison d’être is the elimination of rulers who can make arbitrary mandates that benefit one group at the expense of another.

It’s a common monetary standard, built on rules voluntarily enforced by each individual who is a part of the network. Bitcoin stands against fiat of any kind, whether issued by the government, some private individual or a group of crypto nerds who aspire to be our future overlords.

This is why Bitcoin is widely hated by statists, central bankers, bureaucrats, blockchainers, crapto enthusiasts, fintech people, traders, macro analysts and social justice warriors of all kinds.

They all want you to be subservient to them.

Bitcoin enables you to stand up straight with your shoulders back, to treat yourself like someone you care about, and to be subservient to nobody.

Bitcoin is a tool for maximum personal sovereignty and freedom, and Bitcoiners are your brothers and sisters in arms, who want the best for themselves and encourage you to want the best for you.

Bitcoin is the most economically powerful tool, designed to bring down the corrupt legacy financial system that’s destroyed families, the environment, education, morals, resources and time. Bitcoiners are the peaceful warriors who stand by this vision and will not flinch.

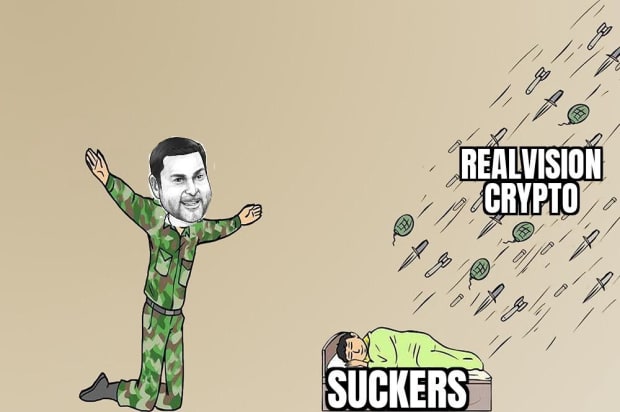

This is why I am a Bitcoiner. There is a huge difference between us and the rest of the “crapto” industry. The following screenshot sums it up nicely:

Warriors, Not Cheap Opportunists

You can always tell a crypto or legacy finance person by the irrational fear they have of just letting go and allowing people to decide for themselves, or their incessant need to want to control everything and their desire to be the ruler.

It’s actually quite pathetic and must stem some from a deep-seated insecurity in their own psyche. Because they don’t have any personal discipline, they need to validate themselves by projecting control upon others.

You’ll also learn the difference between Bitcoiners and the rest of the people in finance and crapto by why they’re here.

Bitcoiners will lock up their bitcoin in cold storage and never touch it. They will work their asses off to generate more value in society so that they can store their new wealth in bitcoin, too. In doing so, they are not only saving for the long term and lowering their personal consumption, but they are net producers that are ripping their economic input out of the legacy financial system. They are starving the beast.

Shitcoiners and traders on the other hand will attempt to gamble their way to fiat riches. Instead of working on things that are meaningful, they’re hell bent on wasting time trying to get rich quick, reading the tea leaves on charts. They add zero value to society. This gambling is one of the diseases of modern society, and something Bitcoin fundamentally stands against.

One of the most brilliant articles on how Bitcoin will de-financialize the world was written by Parker Lewis of Unchained Capital: “Bitcoin Is The Great Definancialization.”

Zero To One, Not One To N

Bitcoin is a transformation of money and finance in which we replace rulers with verifiable, transparent rules that anyone can voluntarily opt into. Crypto, by its very nature, is just a replication of the legacy financial system, in which one set of rulers is replaced with another.

Instead of Jerome Powell and Christine Laggarde, we’re getting Vitalik Buterin and Charles Hoskisson. Out with one group of megalomaniacs and in with another.

This is neither interesting nor desirable.

Just because Ethereum and Cardano share some digital similarities with Bitcoin does not mean they’re anything like Bitcoin. They have an issuer, they have a foundation, they have a core group of operators who decide what the rules are. They have their own plunge protection teams, boards and “key personnel.” The philosophical foundations upon which their technologies are built are no different to modern nation state government and central banking.

All their talk about “governance” and the hero worship of their respective creators makes this so evident that you’d need to be wilfully ignorant to not see it.

The world doesn’t need new rulers.

The world needs a money and monetary network that nobody can benefit from at the expense of another. The world needs skin in the game, social mobility and an equality of monetary opportunity where the productive can ascend no matter who they are or where they come from.

Toxic Heroes

Bitcoiners are called toxic, assholes, bigots, intolerant, amoebas and every other name under the sun, by everyone. We adopt each of those names and transform them into memes. We’re like insult-recycling machines. The ultimate in an antifragile community.

You won’t find this anywhere else. It’s truly a white-blood-cell-type immune system.

We do this because we know Bitcoin is the one shot that we have. Bitcoiners are the most gallant, selfless, courageous and forthright people you will meet because they could very easily sell their souls to some shitcoin organizations and shill you some garbage because they’ve been around long enough and can earn a commission on it, but they won’t.

It’s the only community that gains nothing at an individual level when you buy bitcoin. Unless you’re personally buying billions of dollars’ in bitcoin, you have no bearing on the bitcoin price and on my personal wealth. Bitcoin has no marketing department that pays me to tell you to buy it.

All the other shitcoins are different. They literally pay people to sell their wares, which means you are the sucker buying it.

We stand guard at the gates and call this behavior out. We’ve been doing it from day one, and despite the flack we get, we continue, because we know why we’re here.

We are mission driven. And that mission is to fundamentally save the world.

We’re here to save the lifeblood of humanity, it’s time, energy and resources not by some decree, but by encouraging each and every one of you to become a responsible, sovereign individual who owns the product of their labor.

We’re playing the long game.

Time And Waste

Bitcoiners recognize that the greatest plague to humankind is waste. Waste in terms of the natural resources and energy we use, and the time spent using them.

At a fundamental level, money represents three things:

- Time

- Energy

- Natural resources

Fiat money is the most wasteful creation on the planet because it does not accurately measure any of these. In fact, by willy-nilly creating it out of thin air and squandering it, the price “the system” pays is a complete devastation and irreversible loss of each.

When a government creates a bunch of money out of thin air, it filters through the economy, is used to transform scarce resources into some plastic junk we don’t need, so it can be blindly consumed by someone whose personal time preference has been deranged.

I wrote about this at length in this piece which I encourage you to read, “Fiat, Fascism And Communism.”

Crypto, fiat and the rest of these legacy machinations exist not to eliminate waste from the system, but to create more waste and more confusion, while a few new overlords get rich at your expense.

It’s madness. And the problem is people are so hell bent on trying to make it through and “win” the fiat zero-sum game that they will throw caution to the wind and burn through any amount of reputation, resources, time and energy just to “make a quick buck.”

It’s a sad, nihilistic state of affairs, and one which Bitcoin changes at the core — but will take time.

This is why it’s about time you stood up for what’s right. It’s about time you joined us and actually made a difference, by putting your money, your blood, sweat and tears, where it counts.

There is nothing on earth today that’s going to have a more positive, long-term impact because nothing else changes the base incentives of the individual (and as such, their behavior) as Bitcoin does.

The sooner you become a part of that change, the better not just for you, but for the world. For more on why, read the Jordan Peterson series on Bitcoin here: “Bitcoin, Hierarchy And Territory.”

In Closing

Bitcoin is profound and unique, not for any single reason listed above (notice I barely even touched on the technological reasons), but because it is all of them combined.

It’s a complex, emergent system that has developed path dependently, in an adversarial environment from day 1.

This cannot be replicated no matter how hard anybody tries. It’s as close to immaculate conception as we will ever come.

But….Despite everything I’ve said, many of you will continue on with either your no-coining or shitcoining. You will say, “It’s ok, I can beat Bitcoin,” or, “I don’t need it,” or, “It can’t be that important.”

And while those statements couldn’t be further from the truth, I’ll leave you with one more harsh, but important truth:

Bitcoin doesn’t need you. You need Bitcoin.

I wrote a short, brutal piece about this last year, which if you’re in the shit- or no-coiner camp, I dedicated to you: https://medium.datadriveninvestor.com/do-not-buy-bitcoin-75da73226530

It matters not if you’re an individual, a community, an organization or a nation, you will only ignore Bitcoin at your own peril. The decisions you make today will ensure you’re either a footnote, or a maker of history. So choose wisely.

The idea that the world is going to run on a bunch of different monies, issued by a million different people, is like assuming we’re all going to speak English to each other with a different number of vowels and consonants.

It’s not only inefficient, but a categorically broken method of energy transmission that’s simply a remnant of a fiat money world. Will there be new forms of fiat that sprout up all over the place along the way? Yes, of course, but each of them will trend toward their moral value (zero) because any sucker that supports a new overlord will only impoverish themselves in the process, while their overlords and shitcoin heroes buy bitcoin, knowing it cannot be beaten.

Bitcoin is stronger than ever today and its influence, economic mass and gravitas will only continue to grow.

Bitcoin or shitcoin.

The choice is yours to make.

Think deeply.

Choose wisely.

This is a guest post by Aleks Svetski. Opinions expressed are entirely their own and do not necessarily reflect those of BTC Inc or Bitcoin Magazine.