- May 12, 2021

- Posted by: admin

- Category: BitCoin, Blockchain, Cryptocurrency, Investments

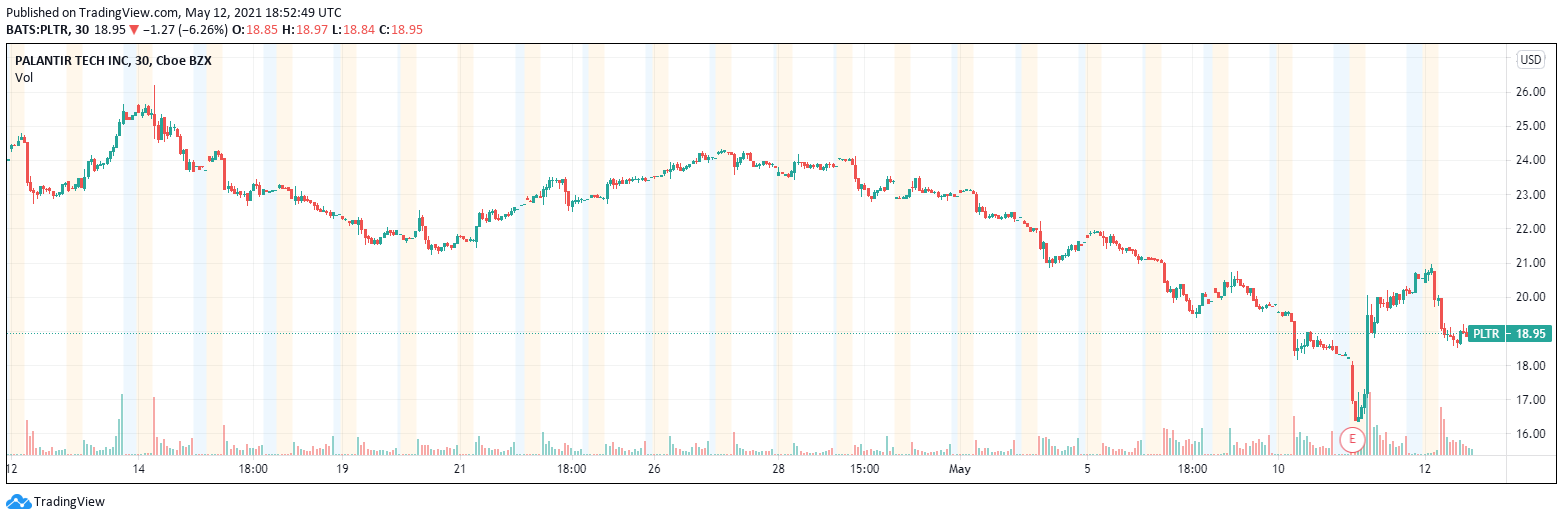

Earlier Tuesday, data analytics company Palantir announced that it will begin accepting Bitcoin as a form of payment. Palantir is responsible for providing software and analytics tools for governments and corporations. The company went public on the NYSE last September with a valuation of $16.5 billion — which has now nearly doubled to $30.44 billion.

During the firm’s first quarter earnings call, CFO Dave Glazer stated that Palantir was “open for business” in regards to Bitcoin and would also consider holding the digital asset on its balance sheet.

“[W]e’re thinking about it, and we’ve even discussed it internally. Take a look at our balance sheet, $2.3 billion in cash at quarter end, including $151 million in adjusted free cash flow in Q1. So it’s definitely on the table from a treasury perspective, as well as other investments, as we look across our business and beyond.”

If the latter comes to fruition, the Colorado-based software company would join a growing list of companies that are holding Bitcoin on their balance sheet.

How Tesla and Microstrategy Helped Change the Corporate Paradigm on Bitcoin

Back in February, Tesla revealed that it had purchased $1.5 billion in Bitcoin, citing reasons for “more flexibility to further diversify and maximize returns on cash.” In a span of a quarter, the EV maker’s $1 billion in profits from Bitcoin alone had exceeded its 2020 profits of $700 million.

Microstrategy was also one of the early adopters of Bitcoin, amassing a total of 91,579 Bitcoins at an average price of $23,311 per coin. With Bitcoin’s price hovering around $55,000, their initial stake of $2.23 billion had more than doubled to $5 billion. Like Tesla, Microstrategy’s yearly revenue of $480 million pales in comparison to the revenue generated by its Bitcoin holdings.

In a way, Tesla and Microstrategy are setting the precedent; more and more high-growth tech companies are realizing that their golden ticket to profitability may lie in cryptocurrencies.

Despite nearly 17 years in operation, Palantir has never once been profitable through its primary business functions. With expenses continuing to grow at a faster rate than revenue, Palantir’s path to profitability in the near future undoubtedly lies in Bitcoin.

Featured image from UnSplash