- April 21, 2021

- Posted by: admin

- Category: BitCoin, Blockchain, Cryptocurrency, Investments

The latest mania surrounding non-fungible tokens (NFTs) is seemingly cooling off as sales revenues have decreased nearly by half in just one week, blockchain data and news outlet PANews pointed out today.

#PAData The #NFT fever is fading as the #NFTs sales revenues in last 7 days dropped 42.43% to ~US$45.26M on Apr 21 from the $79.62M on Apr 14, according to @nonfungibles, which also decreased by 12.48%, compared to that on March 23.

https://t.co/EnogPwOaGc pic.twitter.com/uOOuNaFvi3

— PANews (@PANewsOfficial) April 21, 2021

The NFT train

NFTs are a special type of non-interchangeable tokens that have taken the world by storm over the past couple of months. Unlike “common” cryptocurrencies, each NFT is unique and scarce—qualities that are highly valued by collectors. NFTs can contain all kinds of digital data such as artworks, music, photographs, videos, and so on—or even combinations of them.

Per the report, daily revenues from sales of NFTs have declined by 42.43% over the last week—from $79.62 million on April 14 to $45.26 million on April 21. This suggests that collectors are becoming less eager to pay thousands or even millions of dollars for digital certificates of ownership that NFTs represent.

Notably, NFT sales on secondary markets—where people are basically reselling their tokens bought from original creators—historically have been even higher. However, they saw a drop too.

The #NFT secondary sales revenues hit ~US$27.64M while the primary sales totaled ~$17.63M. In the last 30 days, the highest single-day of primary sales revenues hit ~$21.76M while there were only 4 days that the single-day sales on the secondary market were under ~$21M. #PAData pic.twitter.com/fYeeID5ziq

— PANews (@PANewsOfficial) April 21, 2021

What do on-chain metrics show?

Over the past week, the total number of NFT sales on secondary markets decreased by 24.63%, amounting to around 25,400. Similarly, the number of active market wallets dropped to roughly 12,000, meaning that 42.43% of active participants of the NFT market stopped making trades.

At the same time, the number of NFT sales and active wallets dropped by 41.2% and 38.37%, respectively, in the last 30 days.

As CryptoSlate reported in early April, analysts from financial publication Bloomberg also suggested that declining prices could signify that the NFT craze might be fizzling out.

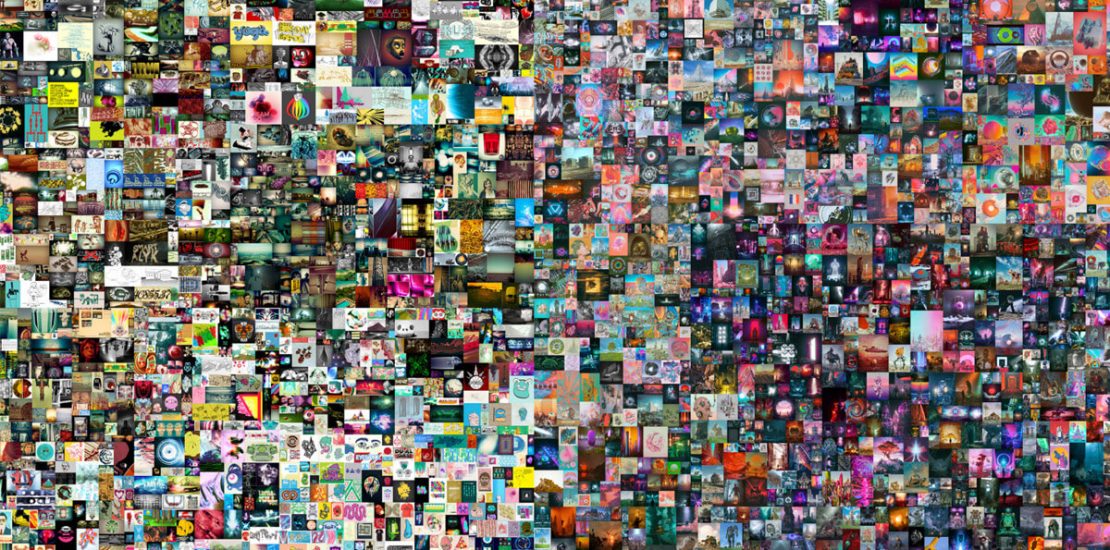

According to the report, the average price of NFTs peaked at around $4,300 on February 22 but has dropped to about $1,400 by April 4. Notably, this all-time high coincided with the record-breaking sale of “Everydays: The First 5000 Days”—an NFT artwork created by crypto artist Beeple—for over $69 million.

Meanwhile, despite the falling hype, some NFT fanatics continue to build out subcultures in the niche space. Plots of ‘virtual land’ have been selling for over half a million dollars, and there are even virtual arenas with virtual musicians selling virtual merchandise.

The post Data shows NFT sales fell 40% last week amidst market pullback appeared first on CryptoSlate.