- November 28, 2024

- Posted by: admin

- Category: BitCoin, Blockchain, Cryptocurrency, Investments

Bitcoin’s recent correction to $92,000 came after failing to breach the psychological resistance at $100,000, a critical level expected to mark a new chapter in the ongoing bull market.

While corrections of up to -30% are frequent during bull runs, the sharp decline below $93,000 caused a segment of short-term holders (STHs) to realize losses.

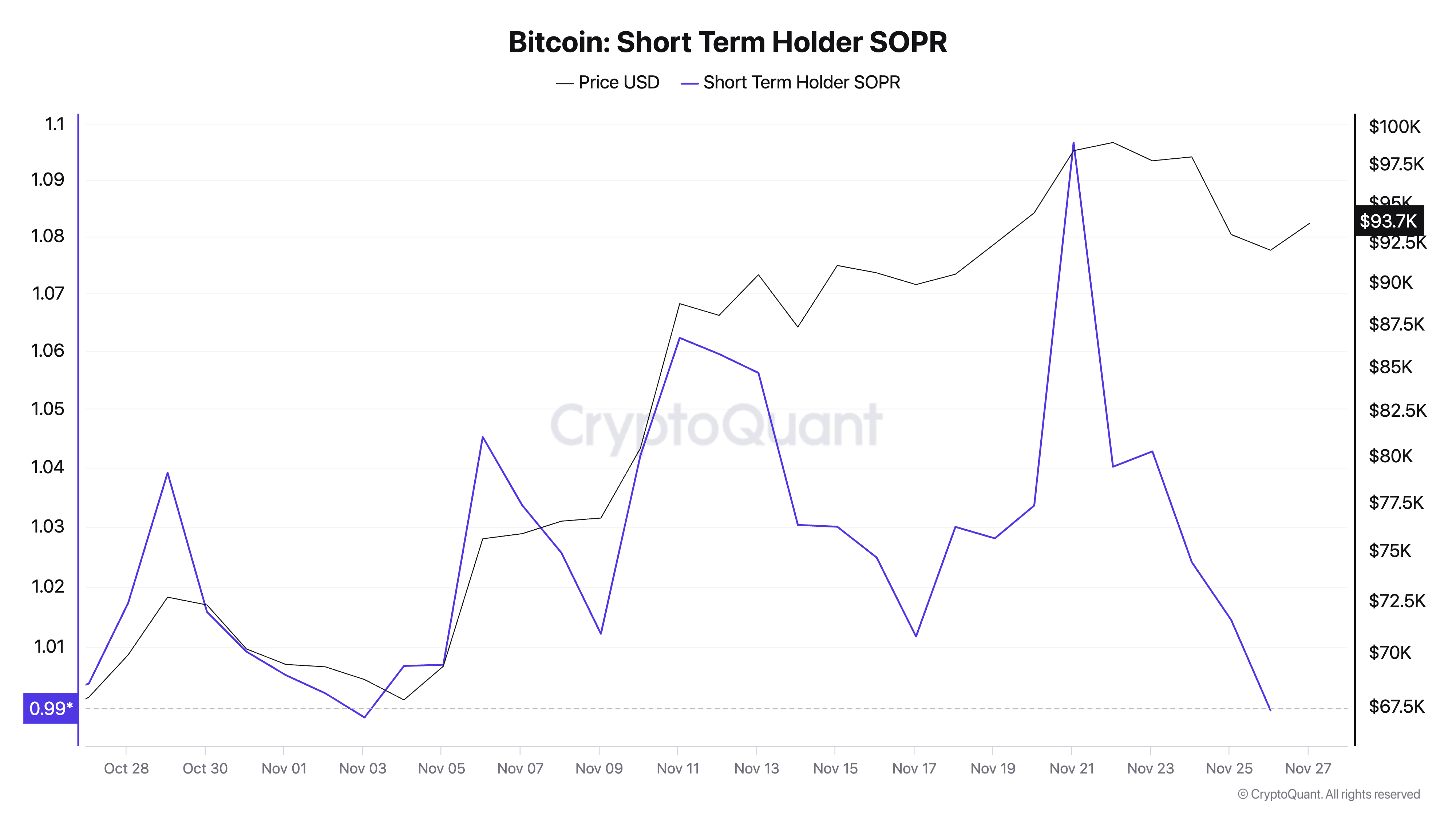

The spent output profit ratio (SOPR) measures the profitability of coins moved within a specific timeframe. When applied to short-term holders (STHs), i.e., addresses that have held onto their BTC for less than six months, the ratio enables us to measure the profitability of coins moved by this particular cohort.

Short-term holder SOPR is calculated by dividing the value of spent outputs at the time of spending by the value of the same outputs at the time they were created. A value above 1 indicates that coins are being sold at a profit, while a value below 1 signifies realized losses. When STH SOPR trends higher, it signals improving market sentiment and conditions for short-term holders, whereas a declining SOPR reflects deteriorating profitability and potentially weaker sentiment among short-term investors.

On Nov. 17, as Bitcoin was trading just below $90,000, STH SOPR stood at 1.0117, indicating marginal profitability among STHs. By Nov. 21, when Bitcoin reached an all-time high of $98,430, STH SOPR surged to 1.0966, reflecting widespread profit-taking as prices neared six-figure territory.

However, as Bitcoin’s price dropped, STH SOPR declined to 1.0144 on Nov. 25 and fell below 1 on Nov. 26 to 0.9995. This marked a critical shift — short-term holders, on average, started realizing small losses, a stark contrast to the earlier phase of profit-taking.

The drop in STH SOPR shows the psychological impact of Bitcoin’s failure to sustain its rally above $100,000. During bull rallies, sustained values above 1 indicate strong market confidence, as STHs are willing to sell at a profit, confident that others will buy higher.

The dip below 1 suggests increasing hesitancy, potentially driven by panic selling or forced liquidations. This is important to monitor as it often marks the capitulation of weak hands, cleansing the market of excessive leverage and speculative positions.

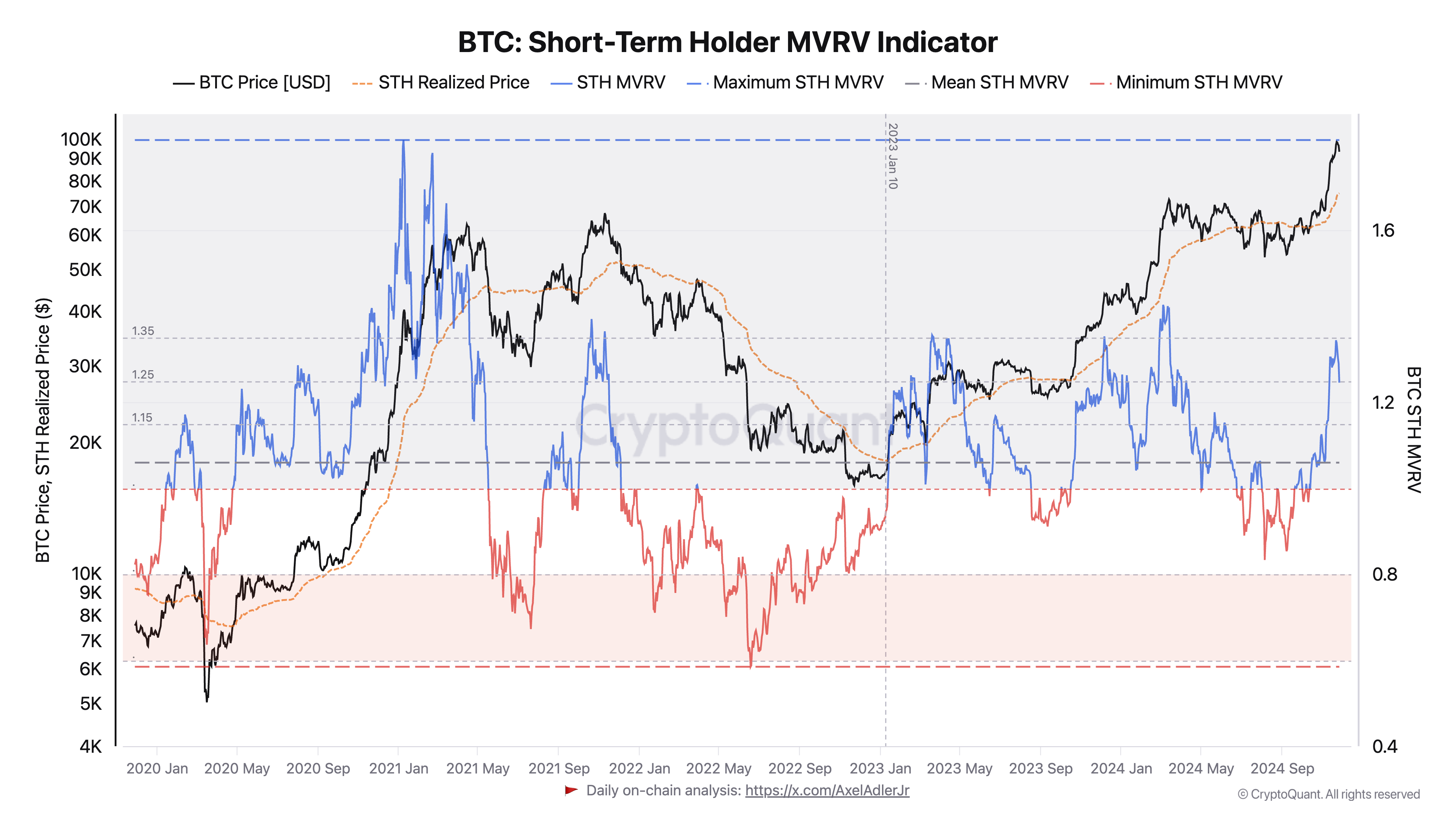

Changes in the short-term holder market value to realized value (MVRV) ratio further indicate such capitulation is taking place. MVRV measures the unrealized profit or loss of a group of holders by comparing the market value of their holdings to their realized value. A value above 1 indicates that STHs, on average, hold coins at a profit, while a value below 1 suggests unrealized losses.

On Nov. 21, STH MVRV reached 1.3447, signaling that short-term holders were sitting on a 34.47% average unrealized profit during Bitcoin’s rally. However, by Nov.26, the STH MVRV declined to 1.2459, showing reduced profitability after Bitcoin’s correction. The decline in MVRV aligns with the drop in STH SOPR, confirming that profitability for STHs was eroded as prices fell below $93,000.

These two ratios reflect the psychological toll rapid price declines have on short-term holders. Realized losses, particularly among STHs, tend to exacerbate negative sentiment and accelerate capitulation.

However, this phase of capitulation may serve a constructive role in the broader market cycle. By shaking out overleveraged positions and weak hands, the correction could establish a more solid foundation for Bitcoin’s next leg upward. The recent decline in STH SOPR and MVRV appears to have reset the short-term market, potentially clearing the way for stronger support levels around $92,000 to $93,000.

However, if the decline in STH SOPR and MVRV persists or accelerates, it may signal deeper underlying weakness in the market. Extended periods of realized losses among STHs could undermine confidence, leading to further sell-offs and a prolonged downturn.

Additionally, the failure to sustain levels near $100,000 could dampen the enthusiasm of institutional investors and retail participants alike, creating additional resistance to any recovery attempts.

Ultimately, the correction below $93,000 and the resulting behavior of STHs reflect the natural ebb and flow of a volatile market. While realized losses have shaken out weaker participants, the broader structural narrative remains intact. Bitcoin’s historical resilience, coupled with a potential reset in leverage and speculative positions, suggests the possibility of a renewed uptrend.

The post Short-term holders hit with losses as Bitcoin fell below $93k appeared first on CryptoSlate.