- November 20, 2024

- Posted by: admin

- Category: BitCoin, Blockchain, Cryptocurrency, Investments

The post Bitcoin Sell-Off and Market Correction: What’s Next for BTC? appeared first on Coinpedia Fintech News

Bitcoin’s market is looking pretty shaky right now. After all those months of solid growth, it’s like the wind’s been knocked out of the sails. And it’s not just a random dip either—there’s a bit of a story behind it. Big players are starting to sell, and it’s changing the vibe. Let’s break it down.

LTHs Are Selling Big—Why’s That Matter?

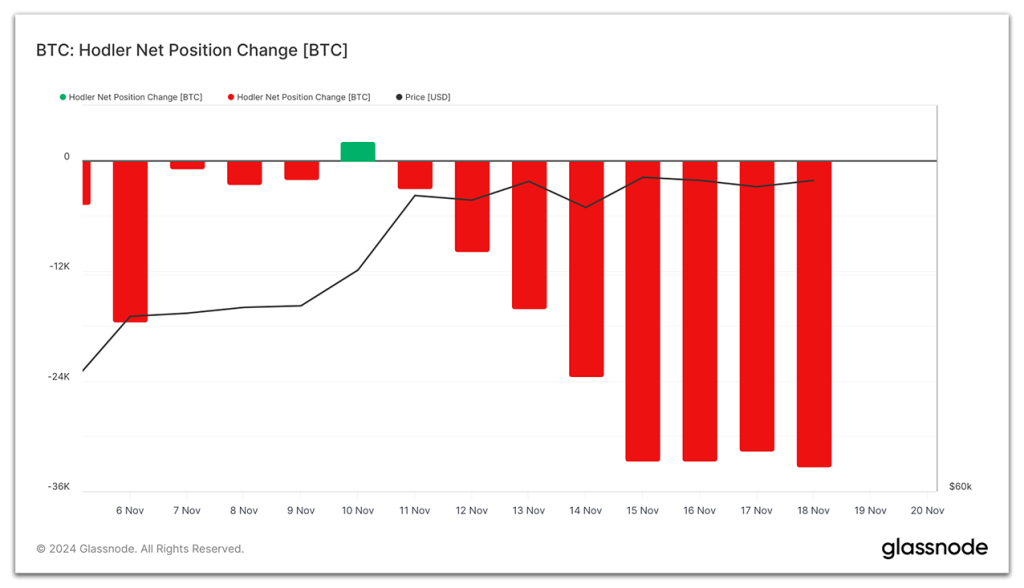

Bitcoin’s Long-Term Holders (LTHs) are doing something pretty rare—they’re selling. And not just a few coins here and there. We’re talking about over $3 billion worth of Bitcoin sold in a single day. That’s huge, and the last time we saw anything like it was way back in June.

Normally, LTHs hold on for a long time, so when they start letting go, it kind of signals they think it’s a good time to cash out. The metric that tracks this, the Hodler Net Position Change, is at its lowest in five months. Something’s definitely shifting.

What Do the Charts Say?

Now, let’s talk about the technicalities. Bitcoin’s price is hovering around $91,952, but it was just over $93,000 not too long ago. So, it’s dropped a little. There’s a key support level at $83,983, and if Bitcoin drops below that, things could get a lot trickier. On the other hand, if it breaks above $93,495, then maybe it’s not the end of the run.

But if we look at the RSI (Relative Strength Index), it’s kind of saying, “Hey, there’s less momentum here.” It’s dropped to 55.91, which isn’t great. Plus, the MACD indicator turned negative, which can usually mean bad news.

- Also Read :

- Trump Administration: Could Guillén Transform the SEC?

- ,

What About All the Liquidations?

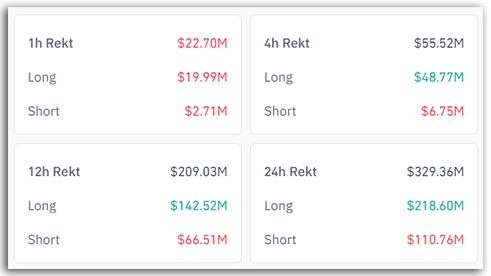

Here’s where things get interesting. In the past day, more than 124,000 traders got liquidated, which means they lost their positions. The total loss? A staggering $329 million. A lot of these traders were holding long positions, betting that prices would keep going up. So, with the market moving in the opposite direction, the bears are starting to take over.

What’s Next for Bitcoin?

Honestly, no one knows for sure, but things are definitely looking a bit uncertain. If Bitcoin keeps falling and breaks that $83,983 level, there could be more pain ahead. But if it manages to bounce back and push past $93,495, maybe we’re in for another run. For now, though, it seems like the market’s in a bit of a holding pattern, and traders will be watching closely.