- October 25, 2024

- Posted by: admin

- Category: BitCoin, Blockchain, Cryptocurrency, Investments

On-chain data shows Chainlink has continued to observe negative exchange netflows recently, a sign that could be bullish for LINK’s value.

Chainlink Exchange Netflows Have Been Negative For Almost A Month

In a new post on X, the market intelligence platform IntoTheBlock has discussed about the latest trend in the exchange netflow of Chainlink. The “exchange netflow” here refers to an indicator that keeps track of the net amount of LINK entering into or exiting out of the wallets associated with centralized exchanges.

When the value of this metric is positive, it means these platforms are receiving a net number of tokens. As one of the main reasons why investors would send their coins to exchanges is for selling-related purposes, this kind of trend can carry bearish implications for the asset’s price.

On the other hand, the indicator being negative suggests the holders are taking out a net amount of the cryptocurrency from the exchanges. Holders generally take their coins off into self-custody whenever they plan to hold into the long-term, so this kind of trend can be bullish for LINK.

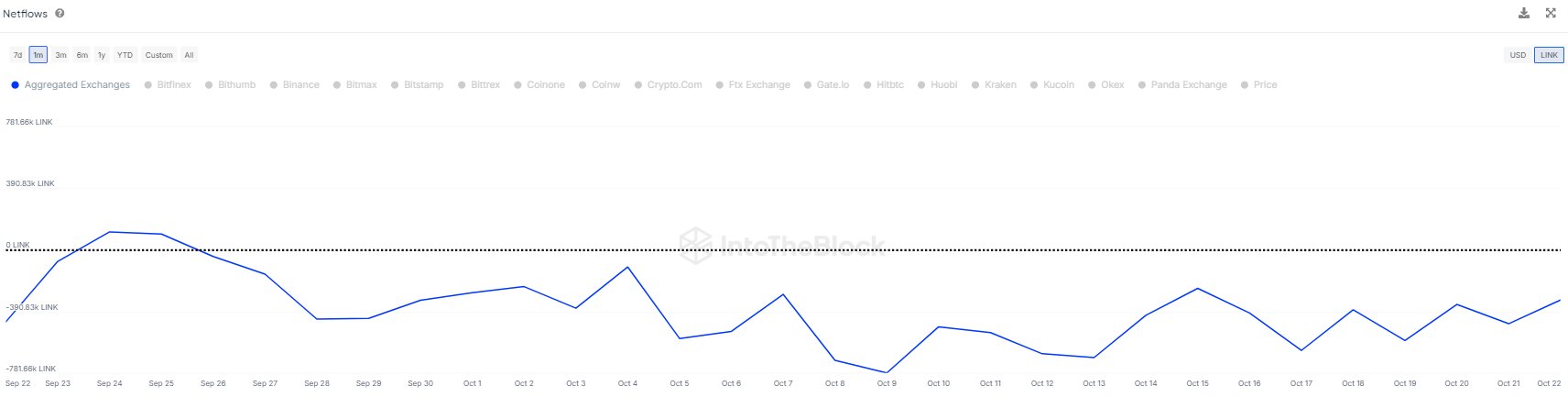

Now, here is a chart that shows the trend in the Chainlink exchange netflow over the past month:

As is visible in the above graph, the Chainlink exchange netflow has been under zero for the past few weeks, which implies the investors have constantly been making withdrawals from these platforms.

“This trend often signals accumulation, as holders move assets to cold storage or private wallets, reducing immediate sell pressure,” notes IntoTheBlock. It now remains to be seen if these net outflows would end up benefiting LINK or not.

The negative exchange netflow isn’t the only potential bullish sign that the cryptocurrency has seen recently, as the on-chain analytics firm Santiment has pointed out in an X post.

The signal in question is for the Weighted Sentiment metric, which tells us about the sentiment related to a given asset that’s currently present on the major social media platforms.

This indicator uses the analytics firm’s machine-learning model to separate between negative and positive posts, and calculate the net picture. It then weighs this value against the total amount of posts present on social media on that day (called the Social Volume).

Below is a table that shows the changes in this metric on different timeframes for various assets in the cryptocurrency sector.

From the table, it’s apparent that Chainlink’s latest daily change in the Weighted Sentiment has been a sharp -372% turnaround, implying that the investors are feeling FUD after the recent bearish price action.

Historically, cryptocurrencies have tended to move against the expectations of the crowd, so whenever the traders become too bearish, a bullish reversal can become likely. Thus, it’s possible that the latest sharp negative sentiment could help the LINK price.

LINK Price

At the time of writing, Chainlink is floating around $11.4, up 4% over the past week.