- September 27, 2024

- Posted by: admin

- Category: BitCoin, Blockchain, Cryptocurrency, Investments

Bitcoin has surged past the critical $65,000 resistance level following several days of bullish price action and growing optimism after last week’s interest rate cuts. This impressive move has excited analysts and investors, who are now speculating on even higher prices in the coming weeks.

The recent rally, fueled by renewed confidence in the market, suggests that BTC could be poised for a strong upward trend.

Key data from CryptoQuant indicates that the average profit for BTC investors has increased significantly yet remains well below previous highs, suggesting room for further growth. This upward momentum reflects a positive shift in sentiment and the potential for BTC to challenge its all-time highs.

As BTC continues gaining traction, market participants closely monitor its price behavior, anticipating whether this surge will lead to a more extended rally.

With Bitcoin’s price action breaking through key resistance and showing signs of strength, the focus is now on whether this momentum will be sustained. Investors and traders are eager to see if BTC can maintain its upward trajectory, pushing past current levels and potentially setting new records in the weeks ahead.

The Bitcoin Network Has Room To Grow

Bitcoin has experienced a remarkable 22% surge since early September, when both price and market sentiment were hovering near yearly lows.

This significant turnaround has sparked renewed optimism among investors, who believe BTC could rally further in the coming weeks, especially following the Federal Reserve’s recent announcement. The shift in sentiment is palpable, with many analysts projecting a bullish trajectory for the flagship cryptocurrency.

One notable on-chain analyst and CryptoQuant researcher recently shared a compelling chart and report on X, highlighting a key metric showcasing Bitcoin’s continued growth potential.

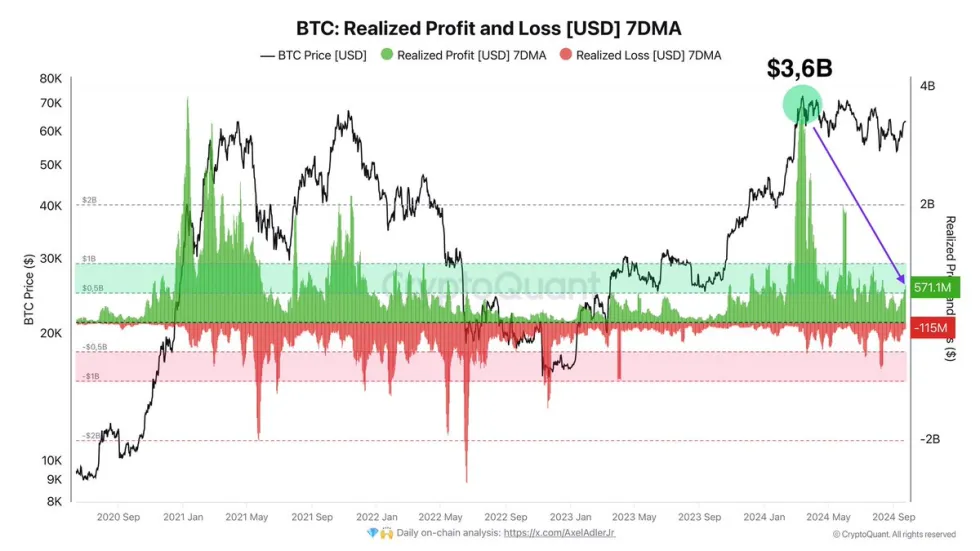

The data reveals that Bitcoin investors are currently netting impressive profits, with an average of $571 million daily profits compared to $115 million in losses. This equates to a net average profit of $456 million daily, a substantial figure pointing to strong market confidence.

Interestingly, these profits, while substantial, are still a fraction of what was seen earlier in the year. In March, realized profits peaked at around $3.6 billion per day, suggesting that there is still considerable room for growth in the current cycle.

This comparison indicates that Bitcoin’s recent price appreciation is just the beginning of what could be a much larger rally, as the market has not yet reached the same levels of euphoria experienced during previous highs.

As BTC continues to gain momentum, market participants are closely watching to see if this trend will persist. The potential for further gains is evident. However, sustaining this upward trajectory will depend on whether Bitcoin can maintain its current momentum and navigate any potential resistance levels in the coming weeks.

BTC Technical Analysis: Price Levels To Hold

Bitcoin is trading at $65,637 after finally confirming a daily uptrend with a solid close above the 200 moving average (MA) at $63,823. This move has sparked positive sentiment among investors, who now anticipate higher prices in the coming days. Market participants see this confirmation as a bullish signal, indicating the potential for further gains.

If BTC can hold above the crucial $65,000 level and continue closing above the 1D 200 MA, the next major supply level to test is around $70,000. Breaking past this resistance could trigger a strong rally, potentially pushing BTC to new all-time highs. However, the price action must sustain momentum to avoid a potential pullback.

On the other hand, if BTC fails to maintain its position above these levels, a healthy retrace to $60,000 could serve as a consolidation phase. This would allow the price to test demand and build a stronger base before any aggressive rally.

Such a correction would not necessarily be bearish, as it could provide a more stable foundation for the next upward move, allowing investors to buy at lower levels before a potential breakout.

Featured image from Dall-E, chart from TradingView