- July 30, 2024

- Posted by: admin

- Category: BitCoin, Blockchain, Cryptocurrency, Investments

Onchain Highlights

DEFINITION: The total amount of futures contracts open interest that is margined in USD or USD-pegged stablecoins. Stablecoins include USDT and BUSD.

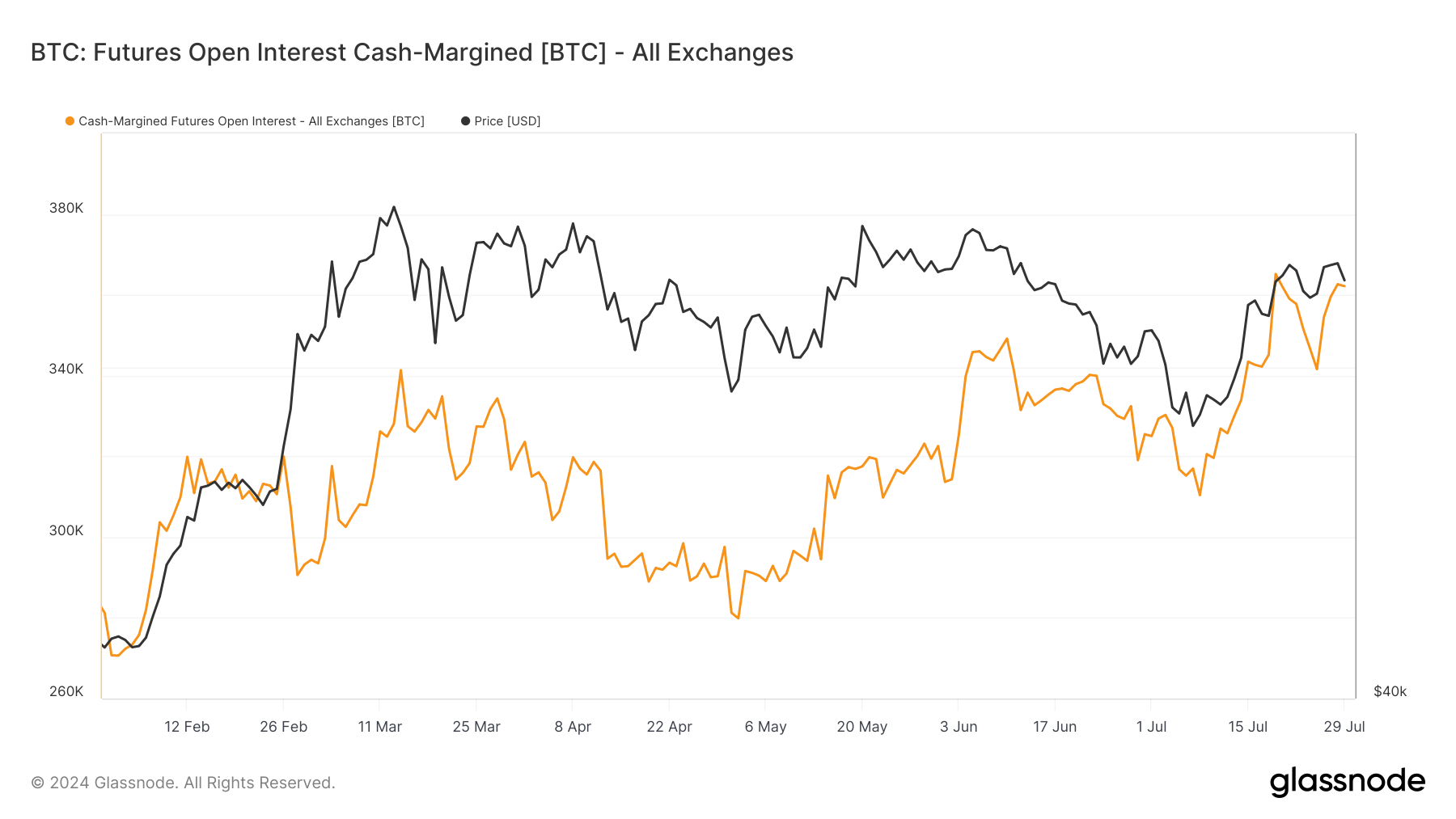

Open interest (OI) for cash-margined Bitcoin futures has been extremely volatile over the past few months. In early January 2024, OI for cash-margined futures on all exchanges started at approximately 280,000 BTC and rose steadily to peak around 340,000 BTC by mid-March. Following this peak, there was a notable decline, bottoming out near 280,000 BTC in early May. This correlated with Bitcoin’s spot price oscillations, as it mirrored the futures market volatility.

After the April halving, open interest surged again, maintaining levels above 300,000 BTC, indicating renewed interest and increased trading activity. This trend suggests that market participants have been positioning themselves for potential price movements.

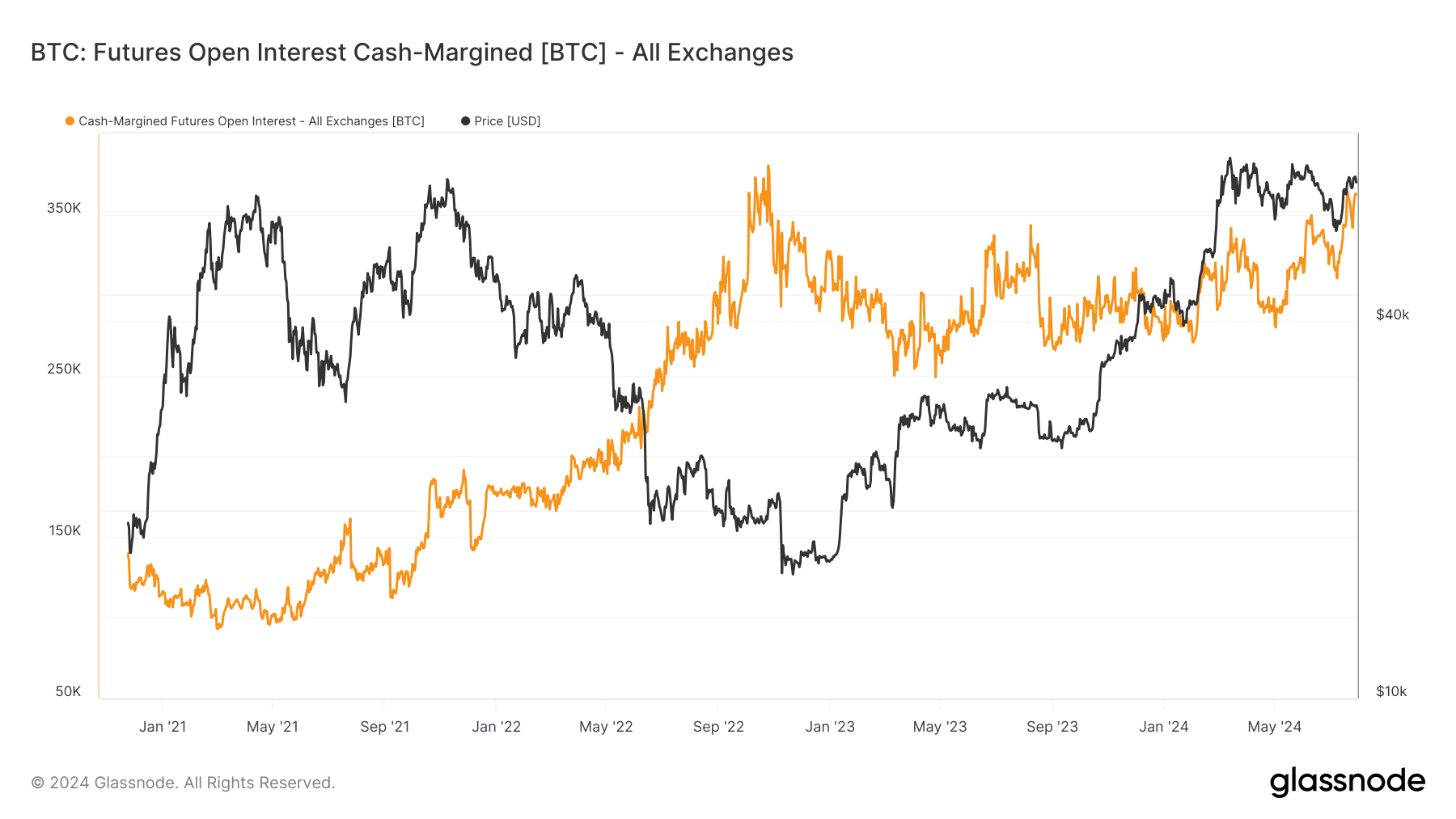

Historical data from January 2021 to mid-2023 shows a consistent growth trajectory in open interest for cash-margined futures, peaking above 380,000 BTC in late 2022 and showing elevated levels despite market downturns. Having Bitcoin’s price align with open interest levels shows the interconnected nature of futures trading and spot market trends.

The post Open interest on cash-margined futures is volatile and tied to spot prices appeared first on CryptoSlate.