- October 31, 2021

- Posted by: admin

- Category: BitCoin, Blockchain, Cryptocurrency, Investments

It’s not uncommon for a project to generate hype, only to collapse weeks later. That’s why it’s especially important for retail DeFi investors to 1) have a framework to analyze projects, and 2) apply this framework before jumping in.

The decentralized nature of DeFi lets anybody participate. It’s surprising how little technical expertise or cash is needed to bootstrap a project or token. The results can be catastrophic for investors who decide to invest without doing due diligence.

Luckily, the flipside of decentralization is that data is transparent and readily available. The data does not lie, so this is where an intelligent investor should first look.

When investigating a project, you can’t go wrong by starting with 3 metrics and 5 charts.

- Total locked value

Chart 1: TVL Growth

Chart 2: TVL Distribution - Market cap

Chart 3: MC/FDV Ratio

Chart 4: MC/TVL Ratio - Token price & allocation

Chart 5: Token Price Movement

1. Total Value Locked (TVL)

Make sure the project has stable TVL growth.

TVL refers to the total value of assets deposited by users and locked into a protocol. More assets in a project locked means users have more confidence in providing liquidity and collateral for the protocol’s economic activities. This both signal’s the market’s confidence in the project.

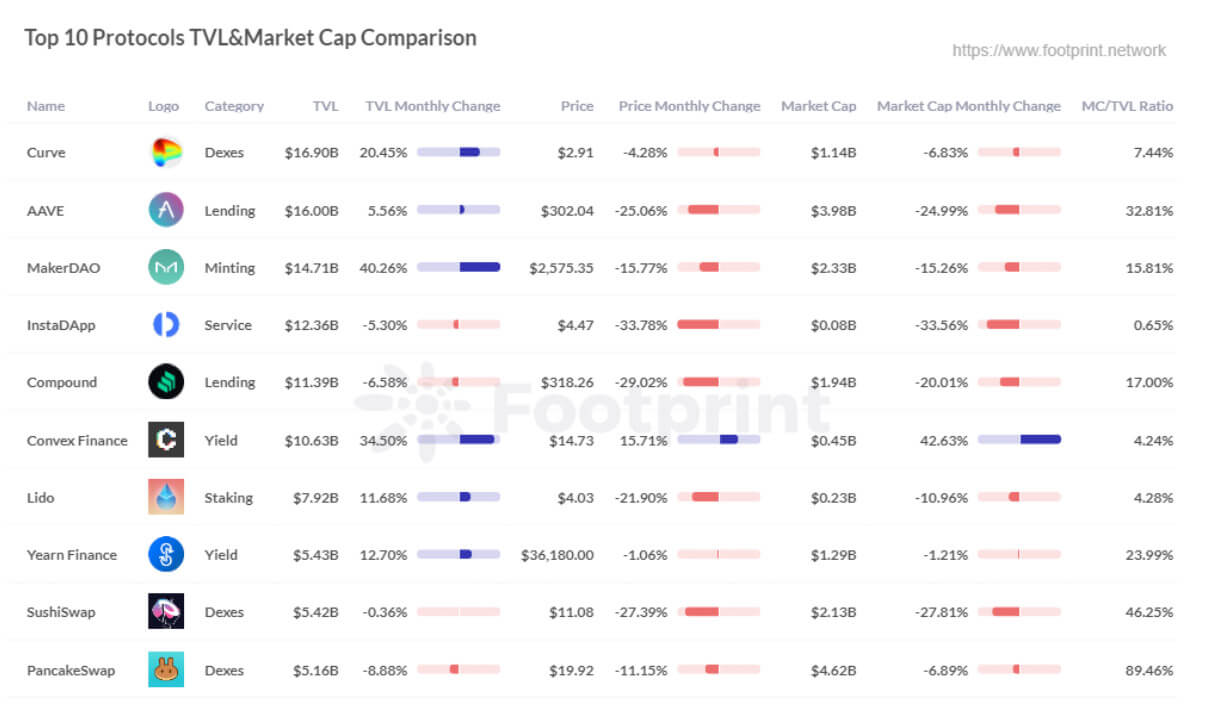

As you can see, the top 10 protocols are of both huge values above $5 billion and stable TVL growth month-by-month. That indicates a project is continuing to maintain its vitality and strength.

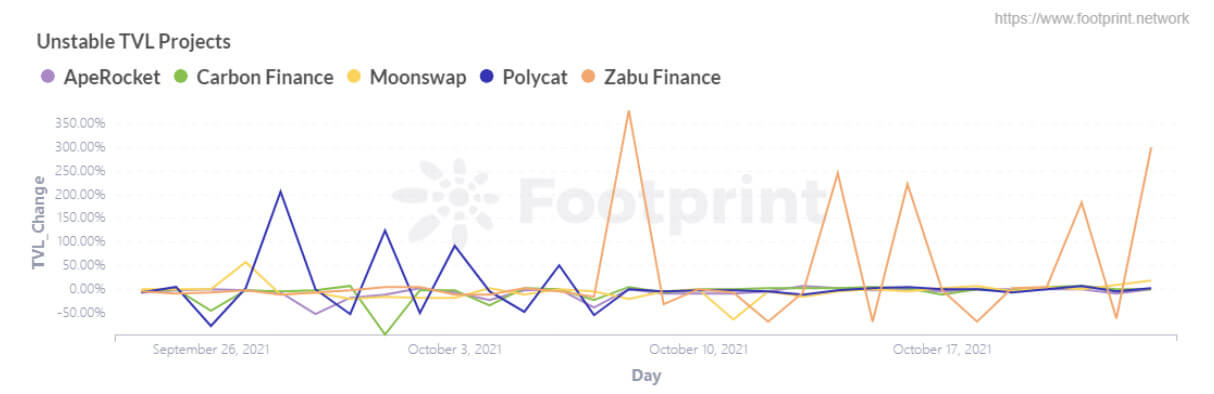

On the other hand, when looking at weaker, less reputable projects, the picture is different. Huge TVL changes per day, with an unsustainable upward trend, usually followed by a significant drop the day after the rise.

Pick projects whose TVLs are “middle-of-the-pack.”

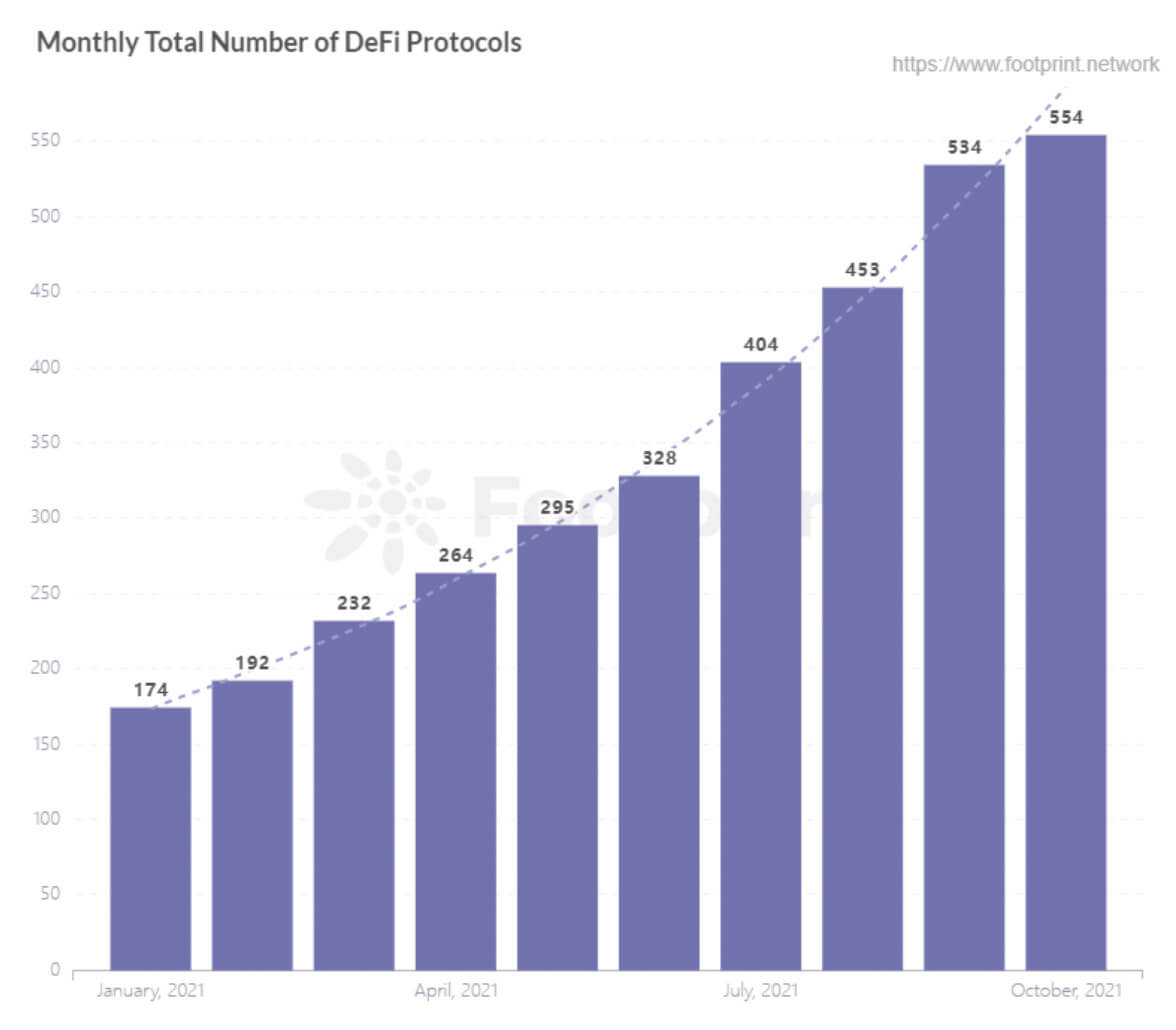

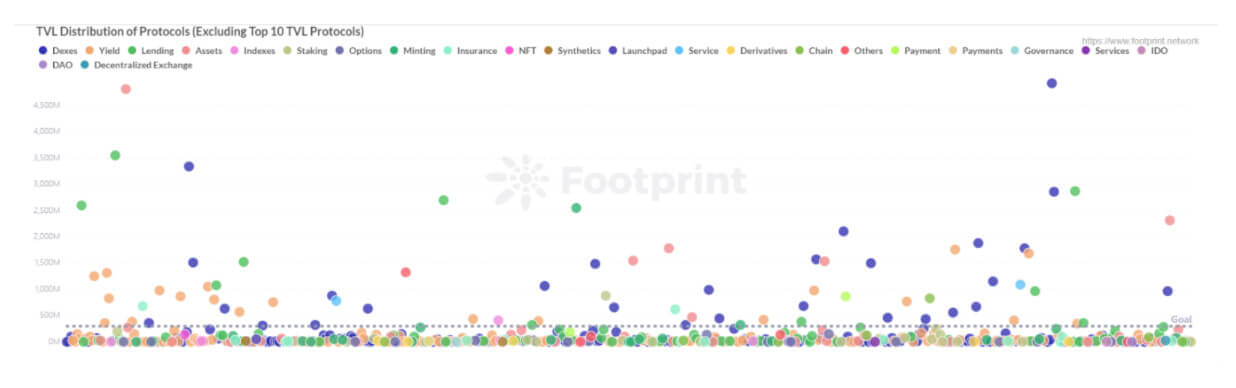

As is clear from the scatter chart below, projects are proliferating like crazy with an extremely uneven TVL distribution. There are currently over 500 DeFi projects, of which 33%have TVLs below $5 million.

This is one of the easiest ways to separate projects into 3 categories:

- Already “priced in” or overleveraged/overvalued

- Completely new, unproven and risky

- Projects with potential

How should you balance risk with reward?

To be on the safe side and to prevent the risk of too small projects running away with their money, individual investors should try to select projects in the middle of the TVL range and above (around $20 million) when deciding who to invest in.

Those in the $1 million to $10 million range are suitable for seed rounds by investment institutions. Individual investors should avoid these because their future positioning and strategic direction is not clear.

While TVL projects in the $10 to 20 million range have found a suitable growth strategy and investors have access to data on this segment, in terms of stability, there is a risk of stunted growth in these projects and a high risk of weak growth or decline if growth is not sufficient.

TVL projects in the $20 million to $50 million range have, to some extent, found a clear fit in terms of product mechanics and growth, with the community and technical support gradually becoming more sophisticated, and are a good choice if you want to achieve higher returns than the top protocols.

If your risk tolerance is low and your need for return is not too high, you can choose projects from the top protocols to invest in based on your preferred DeFi project category (e.g. DEX for providing liquidity, lending for lending, etc.)

2. Market Cap (MC)

Market cap is the most accurate overall reflection of a project’s market value.

This metric is calculated similarly to stocks in the traditional equity market, namely by multiplying the price of the token by the number of tokens in circulation and available for trading.

As the number of tokens is affected by circulation and supply and demand, the price of the token can change quickly. On the other hand, market cap tends to increase or decrease within a 20% range, with no sharp increases followed by precipitous crashes.

This stable quality makes the market cap a good underlying indicator to evaluate projects and identify potential and worthwhile investments.

Avoid low MC/FDV ratios when looking for long-term holds.

Fully diluted valuation (FDV) refers to the maximum supply of tokens multiplied by token price. In other words, it is equal to the market cap when all tokens have been released.

If the MC/FDV ratio of a project’s tokens is low, it means that a large number of tokens have not yet been released. This happens when 1) the protocol is newly live; 2) the total supply of the token is extremely large.

Investors should consider FDV carefully, focusing on the length of time the project has been online and the token supply schedule.

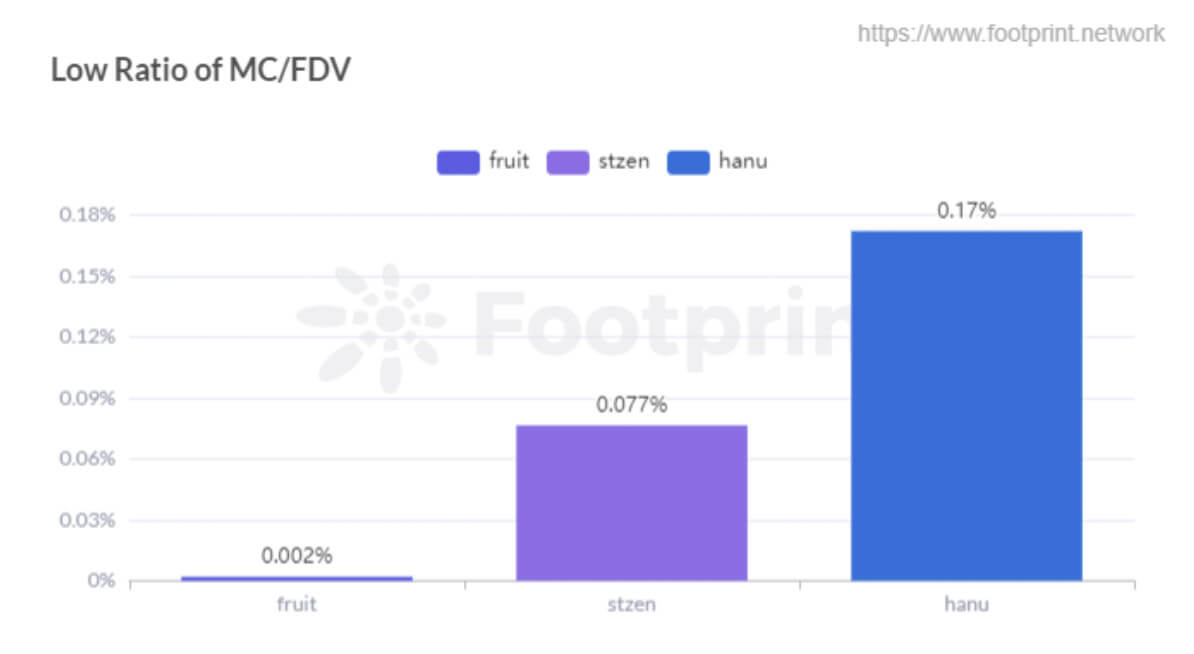

Some examples of projects with low ratios are:

- Fruit: MC/FDV Ratio is 0.002%

- StakedZEN: MC/FDV Ratio is 0.077%

- Hanu Yokia: MC/FDV Ratio is 0.17%

The MC/FDV ratio allows investors to assess whether a token price is overheated. That’s because a low ratio indicates that the supply will eventually be higher than the actual demand once project owners release more tokens. With the demand increasing rapidly, the price will likely drop as the market adjusts.

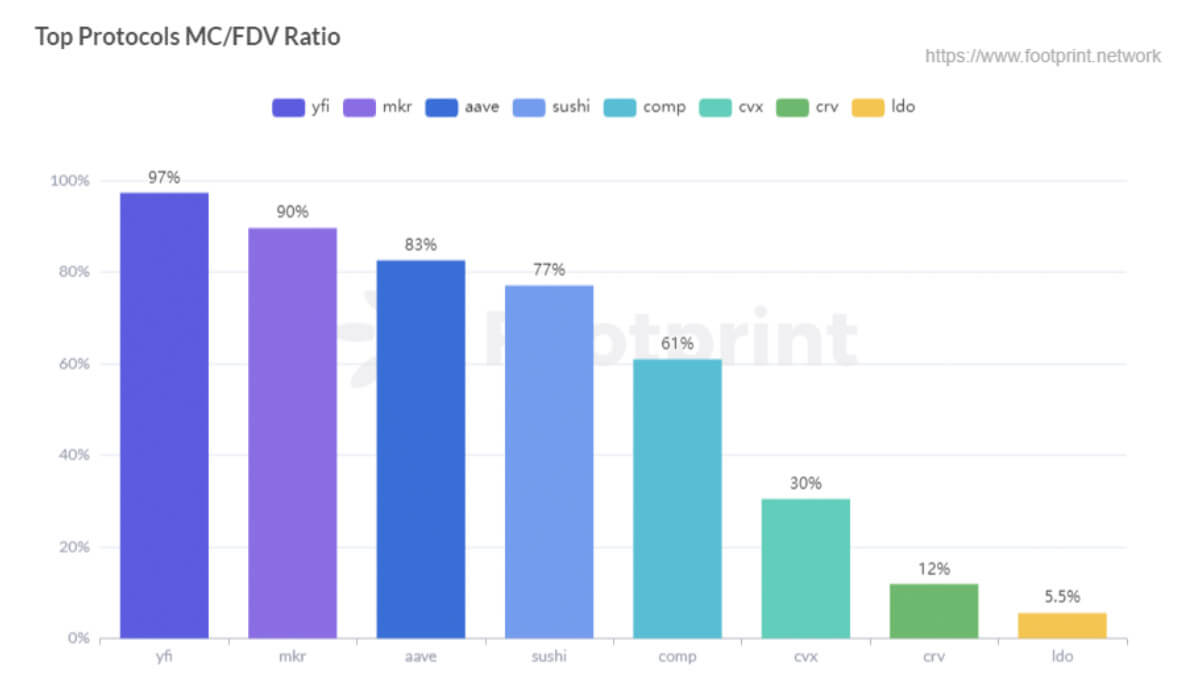

Look at the chart below to see how top-ranked projects looked from a MC/FDV perspective.

Projects with an MC/FDV ratio higher than 60% are better for long-term holding with price security almost guaranteed.

On the other hand, high MC/FDV ratio projects aren’t without drawbacks. They usually have higher entry prices. Though this isn’t always the case, analyzing the data will allow you to make better investments based on your goals.

Curve (CRV), for example, has an MC/FDV of 11.86%. Lido, another lending project, has a lower MC/FDV at 5.54% AND a higher token price. So, when comparing the two, we can see that those looking for long-term DeFi lending projects to invest in should consider Curve over Lido.

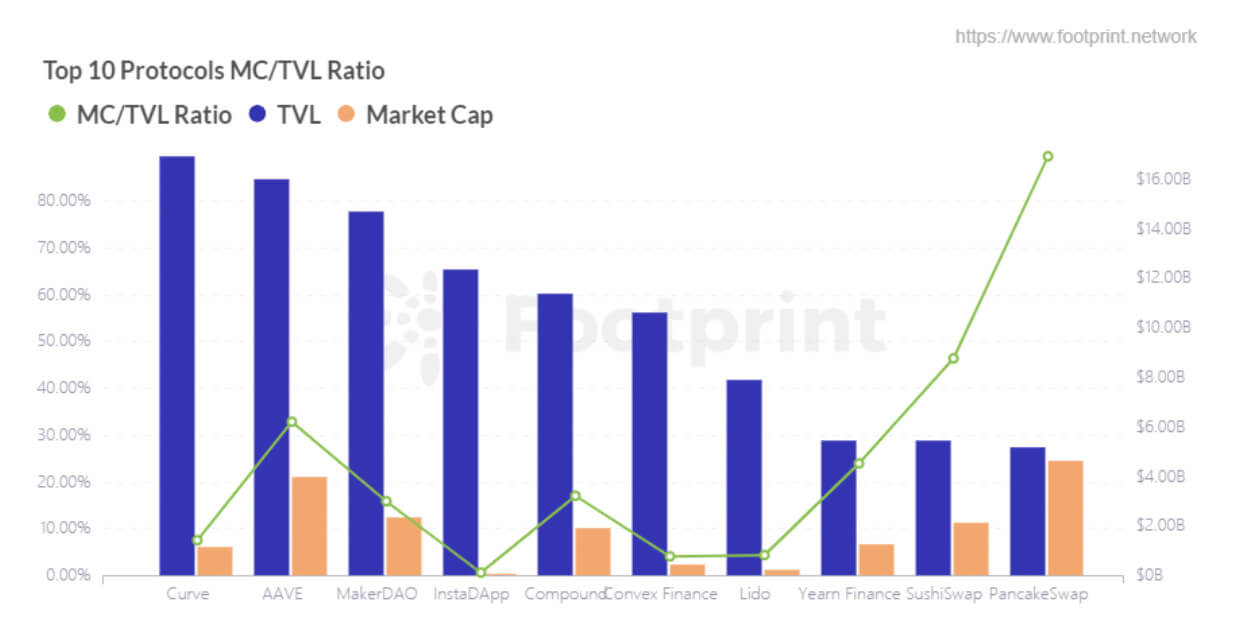

Keep an eye out for projects with a low MC/TVL ratio.

The current MC/TVL ratios of the top 10 TVL projects are almost without exception less than 1. This means that these projects are undervalued and worth investing in. Here’s why:

From an economic perspective, the higher the TVL of a project, the higher the MC should be because a high TVL indicates that investors have a high degree of confidence in the project’s economic utility.

In other words, when investors lock in their tokens it means that they are utilizing the project rather than speculating. More utilization relative to speculation is usually a good sign.

Therefore, investors should take a gook look at the MC/TVL ratio. A ratio greater than 1 indicates that the valuation may be too high and the investability is low, while a ratio less than 1 indicates that the project is undervalued and the returns are primed to increase.

Remember to always compare projects within the same categories for valid comparisons, and especially compare lesser-known projects’ ratios from those of the top protocols.

2. Stable token price and reasonable token allocation mechanism

Choose projects whose tokens are stable.

Many people do DeFi investing backward. They start by looking at token prices, then do research on the underlying project to justify their (often FOMO-driven) investment.

Instead, you should have already investigated suitable projects using the metrics and indicators explained above.

After you’ve created a shortlist of projects you are interested in, screened for solid fundamentals, you can then look at the token prices.

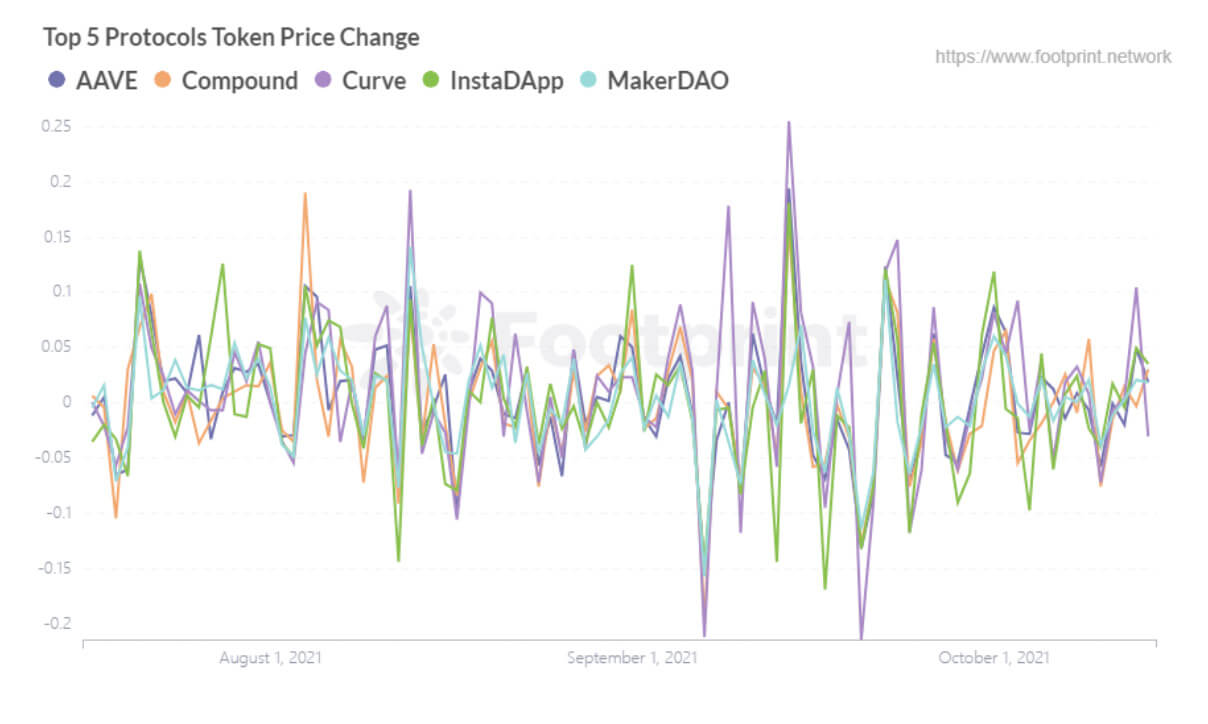

In crypto, “stable” is a relative term.

At Footprint, we recommend being wary of price jumps and drops within 20%. Normally, the extreme change of price indicates an unhealthy market reaction to some news that might just be a pump.

If the token price remains relatively stable, the liquidity of the token is relatively stable also. Therefore, the possibility of damage to the project caused by a large number of individual investors selling tokens is reduced.

As with other metrics, this rule is best applied when comparing your different options on a visualization chart, as above.

The data indicate that InstaDApp and MakerDAO are more resistant to the negative effects of a sell-off than Curve, for example.

Summary: 5 Steps to Assess The Investability of a DeFi Project

When looking for the next project to invest in, start with the fundamentals. Use data to compare projects within the DeFi projects you feel strongly about in your thesis.

The takeaways:

- Stable TVL growth

- Mid-range TVL ranking or above, approximately $20M or higher

- MC/FDV ratio higher than 5%

- MC/TVL ratio less than 1

- Stable token price with monthly fluctuations under +/- 20%

For the above metrics, readers can access them directly in this featured article: Footprint dashboard, entitled “How to Discover Valuable Project”

Furthermore, the tokenomics and the team structure of a protocol are also key reasons to consider when investing. If the percentage of tokens held by the team or foundation is too high, then there is a bigger chance that the project is a money grab.

This can easily lead to a situation where a core group of people can release tokens quickly in an attempt to “cash-out”, leading to a serious dilution of the token price and an increased possibility of the tokens being sold off.

DeFi, as a new investment market, has created more investment possibilities than traditional finance, with many worthwhile projects that are quite slept on.

However, opportunity and risk go hand-in-hand. It’s important to remember that the DeFi market is inherently unpredictable and that even the above indicators are no guarantees for long-term viability.

What is Footprint Analytics?

Footprint Analytics is an all-in-one analysis platform to visualize blockchain data and discover insights. It cleans and integrates on-chain data so users of any experience level can quickly start researching tokens, projects, and protocols. With over a thousand dashboard templates plus a drag-and-drop interface, anyone can build their own customized charts in minutes. Uncover blockchain data and invest smarter with Footprint.

- Website: https://www.footprint.network/

- Discord:https://discord.gg/3HYaR6USM7

- Twitter: https://twitter.com/Footprint_DeFi

The post 5 charts to uncover your next long-term DeFi investment appeared first on CryptoSlate.